Certificate program in BFSI

Empower your career by joining this certificate program which prepares for a steady career within the BFSI Industry. Upon successful completion we offer 100% placement assistance in BFSI companies.

Our dedicated training program encircles and familiarizes each candidate with the basics, as well as the advanced know-how of BFSI sales. Along with the theoretical and academic inputs, our students also get an opportunity to meet respected and renowned industry experts, who mentor them and guide them. With the right guidance and real-time experience, students become more confident and prepared for their endeavours, while ensuring a bright and prospective career growth.

Benefits of the Certificate Program

Highlights of the program

Get Future Ready

This program has been specifically designed for people who are keen on working in the Business Development Division within the BFSI Industry. The content and methodology have been prepared to keep in mind the uniqueness of this industry and make our students future-ready to face challenges and achieve greater height in their respective career.

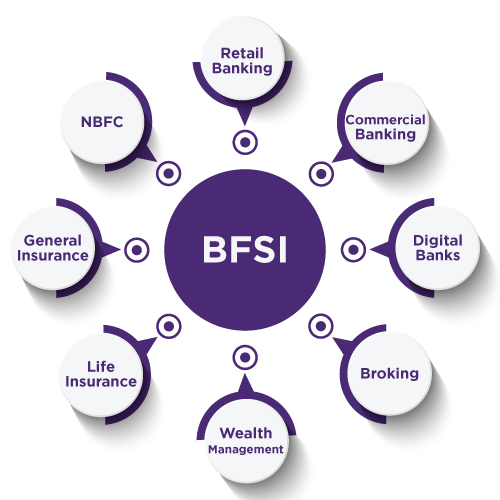

You can choose a career within the wide spectrum of companies within the BSFI Landscape.

What can you expect from a BFSI Career

Secure a career in the most rewarding industry

Program Details

Our dedicated training program encircles and familiarizes each candidate with the basics, as well as the advanced know-hows of BFSI sales. Along with the theoretical and classes, our students get an opportunity to meet respected and renowned industry experts, who mentor them and guide them. With the right guidance and real time experience students become more confident and prepared for their endeavors, while ensuring a bright and prospective career growth.

- Direct Training under Domain experts with 30+ years of experience and knowledge-based curriculum

- 360° holistic training experience including 2 core and soft skills.

- Interactive sessions with the domain experts & Industry gurus.

- Conducting Mock Interviews with the Industry Experts.

- 100% Assistance in placement with reputed companies from BFSI Sector

- Competitive Edge and preferential hiring with our empanelled corporates.

- Assistance in Negotiating with Industry participants.

100 Hours Program Curriculum

Week 1

- Overview on BFSI Sector.

- Indian Financial System.

- Basic of Banking.

- Negotiable Instruments.

- Retail Banking Framework.

- Banker Customer Relationship.

- Know Your Customer Guidelines.

- Banking Laws & Practice.

- Indian Capital Market System.

- Introduction to Depository.

- Depository and Business Partners.

- Function of Depository Partners.

Week 2

- The Market for Securities and its Structure

- Primary Market

- Secondary Market

- Overview on Mutual Funds

- Structure & Constituents of Mutual Funds

- Mutual Funds Products

- Purchase, Redemption and Systematic Transactions

- Financial Planning Process

- Time Value of Money

- Personal Financial Management

- Tax Planning

- Investment and Retirement Planning

- Risk Management and Insurance Decision in Financial Planning.

Week 3

- Basic of MS-Excel.

- Ms-Excel – VLook-up, Pivot and some smart functions.

- MS-Powerpoint.

- Creating Effective Powerpoint Presentation.

- Professional Grooming: Do’s & Don’ts.

- Time Management & Goal Settings

- Thinking Skills.

- Modes of Self Development- Read, Listen, Talk, Ask Write, Observe, Self-Motivation, Being Confident, Self Esteem.

- Email Etiquettes.

- Communication Skills.

- Self-Management Skills.

- Focus, Common Sense & Situational Awareness.

- Time Management, Ambition & Enthusiasm/Optimism.

- Listening Skills, Confidence, Empathy & Self Control.

- Leadership.

- Problem Solving.

- Adaptability.

- Intuition & Logic.

Week 4

- Identification of Prospects.

- Building CRM.

- Focus on Right Leads.

- Leverage you CRM.

- Know Your Product & be Data Informed.

- Listen to Your Prospects.

- Product Presentation.

- Focus on Helping Customers.

- Objection Handling.

- End Each Customer Meeting with Action.

- Build Trust Through Education.

- Seeking Help of Senior Resource or Marketing Team.

- Closing Techniques.

- Customer Onboarding.

- Serving Relationship.

- Problem Solving Attitude.

- What is means to be a SPOC.

- Managing Sales Cycle.

- A journey from Company Representative to Trusted Advisor.